Employer of Record (EOR), also referred to as a Professional Employer Organization (PEO), is a third-party company that manages recruitment, payroll, HR, and compliance functions for businesses, particularly those with employees in multiple locations.

The decision to outsource activities such as payroll is not easily taken save where a trusted partner can be found. Our payroll team consists of dedicated payroll professionals focused on the provision of our confidential, fully managed payroll service.

As your partner, we aim to offer you flexibility and streamline payroll outsourcing services at a competitive price. Our goal is to help you achieve tangible benefits in the areas of cost savings as well as increased service level performances.

- Collect input data and periodic changes

- Handle joiners, leavers or any changes to employee remuneration, hours, benefits etc.

- Manage the payroll and calculate employee salaries

- With each payroll run we provide you with computer-printed payslips, payroll analysis reports, statutory reports and journal reports

- Arrange the net salary payments to each individual’s bank account

- Submit the monthly statutory reports on your behalf and manage the settlement of any resultant dues

- Year-end payroll reporting procedures

Employer of Record (EOR), also referred to as a Professional Employer Organization (PEO), is a third-party company that manages recruitment, payroll, HR, and compliance functions for businesses, particularly those with employees in multiple locations.

- Payroll-related human resource administration is often time-consuming and expensive. You can define your HR objectives and we will use our expertise to cater for your needs

- Compile the necessary employment forms for new recruits and terminated employees

- Resolve questions as they arise

- Handle all communication with relevant authorities

- Prepare employment licence applications

- Personnel file maintenance

- Reporting issues by exception

- Vacation and any other absence records such as maternity, sick etc

- Keep you updated with the latest employment legislation and related tax updates

- Assist with the net of tax payroll calculations

- Advice on fringe benefit (benefits in kind) considerations and calculation of the relevant tax impact

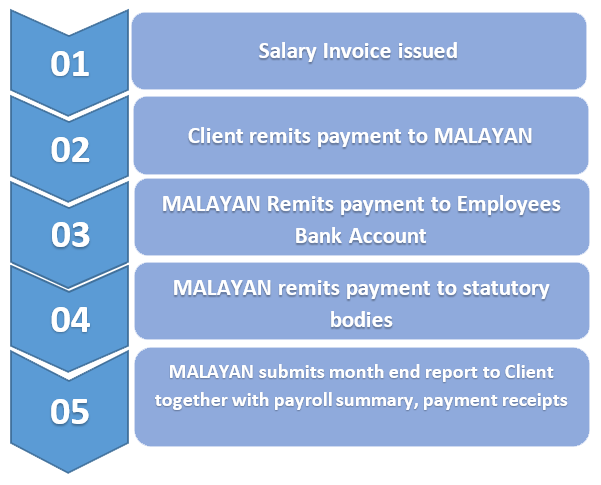

- MALAYAN will compute and finalize the Client’s payroll i.e. claims and monthly salary payouts. This will be carried out in the strictest confidence by MALAYAN based on all payroll-related information provided to MALAYAN by the Client and statutory Bodies in Malaysia.

- MALAYAN will provide additional services to assist the Client in capturing and screening information submitted by the Client, ensuring compliance with the Client’s company policies, procedures, and all government regulations.

- MALAYAN will seek the Client’s authorized payroll signatories for their signatures on the Letter of Instructions to multiple banks prior to the designated date of credit.

- MALAYAN will make timely cheque /bank transfer requests every month and funds requisition to the Client for the payment of salaries and wages via multiple bankers, statutory payments, namely, EPF, SOCSO, and EIS, salaries by cheque/ Bank Transfer, namely resignations and new hires after the monthly payroll cut-off date.

- MALAYAN will remit all payments stipulated in item 4 with the relevant documentation to the relevant bodies before their respective deadlines. This will include bank transfers /banking cheques in employees’ bank accounts.

- A schedule will be agreed upon between MALAYAN and the Client, stipulating the deadlines for:

- Submission of data (employees’ information/ allowances/ deductions/ resignations/ new hires, etc.) to MALAYAN;

- Submission of reports to the Client for vetting before finalization of payroll;

- Preparation of funds and payment of salary to employees via bank accounts or other means;

- Submission of reports to the Client for record-keeping;

- Bank Transfer /Issuance of cheques by the Client as payment to statutory bodies

- MALAYAN will prepare all standard payroll reports, after each payroll period as follow:

- Payroll summary

- Allowance and deduction reports

- Overtime reports

- Salary reconciliation reports

- Bank listing

- Should you have many companies under one group of companies, MALAYAN will print out all reports for different entities as well as consolidated reports for management decision purposes.

- MALAYAN will email payslips for every monthly payout, sorting and distributing them directly to all locations with the client's employees throughout Malaysia.

- For any new staff employment or resignations, MALAYAN will submit all relevant documentation to the appropriate authorities on your behalf.

- On an ad-hoc basis, MALAYAN will prepare necessary reports requested by the Client, but within the capability of payroll. However, as and when there is a need for additional assistance in any payroll matters that will have to be accomplished as a project; then a formal quotation will be prepared for the Client.

- MALAYAN will function as a helpdesk for all the Client’s payroll matters, answering calls and emails daily. Our office hours are from 9.00 am to 6.00 pm Mondays to Fridays. Despite our office hours, MALAYAN is happy to support you via our on-call service numbers for urgent matters during the weekends.

- MALAYAN will prepare the accounting journals for payroll cost and accounting journals for financial month-end provisioning in the format required by the Client.

- Compute leave balance based on financial month-end and upload the information to the Client’s accounting system for computation of leave accrual.

- MALAYAN will perform reconciliation on all payroll-related accounts and prepare adjustment journals for the reconciliation on a monthly basis.

Outsource your payroll to Malayan for as low as 3% per month (No hidden charges) and we will take the headache out of payroll for you.